Otherwise, we hope the explanation above has helped you wrap your head around what a DCF analysis is, and how to use one. Note that in theory the above three approaches should deliver an identical valuation result thus the choice of what method to use is simply down to the level of information at hand and personal preference. Working backwards from this larger value using the market rate can, conversely, tell us how much less money we would have losing, say, 10%, each year. The further in the future, the more you discount it and thus the lower the discount factor. U.S. Treasury bonds have risk-free rates as they are guaranteed by the U.S. government, making it as safe as it gets.

- This integration eliminates double entry, reduces reconciliation time, and provides a more accurate view of financial position.

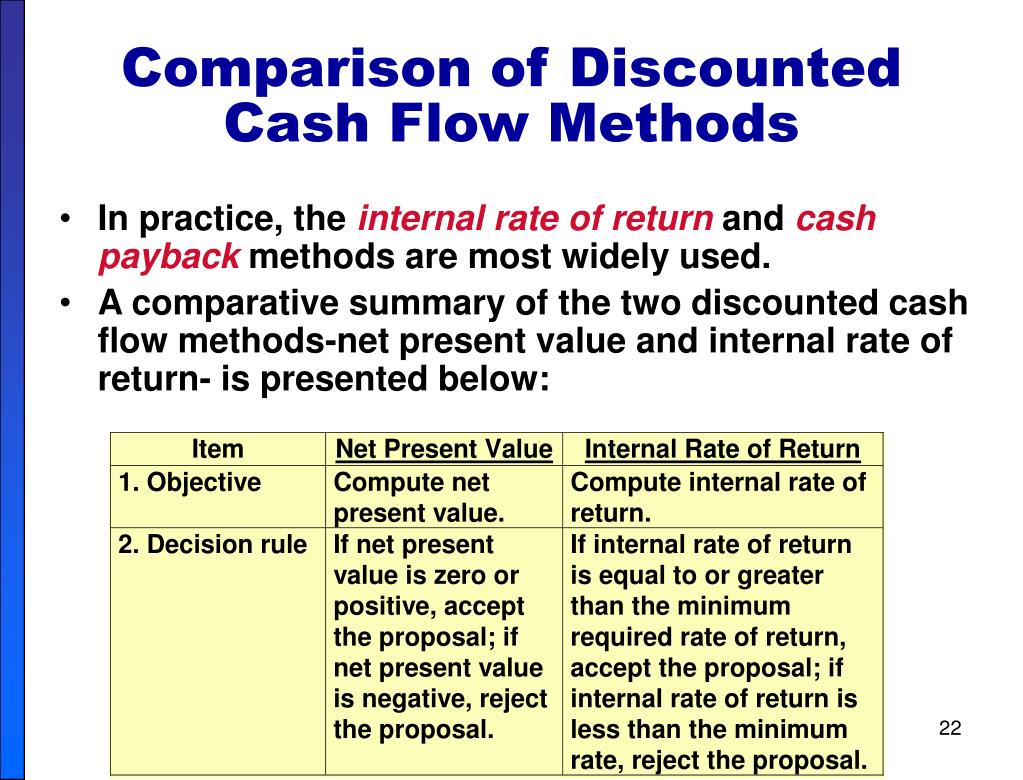

- The DCF method takes the value of the company to be equal to all future cash flows of that business, discounted to a present value by using an appropriate discount rate.

- Estimating too highly will result in overvaluing the eventual payoff of the investment.

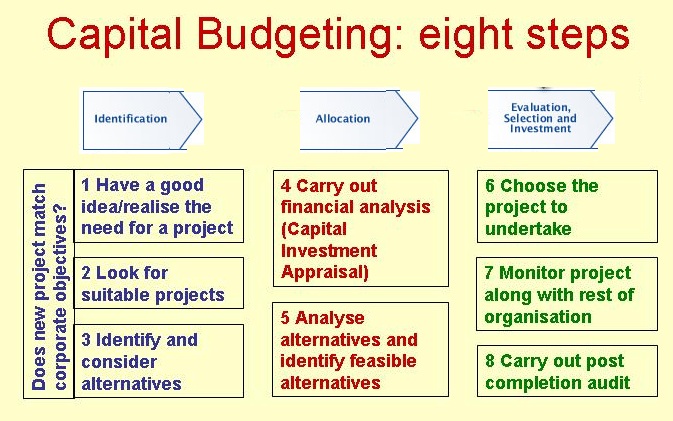

- Let’s explore how automation enhances various aspects of capital budgeting.

- Since the required rate of return was 7%, Rayford would consider investment in this metal press machine.

Reduced manual errors in financial analysis

Implement robust systems for monitoring actual project performance against initial projections. Consider best-case, worst-case, and most likely scenarios when evaluating projects. This short-term bias can lead to missed opportunities for sustainable growth and competitive advantage. Organizations should establish standardized leveraged loan funds evaluation frameworks that consider both quantitative and qualitative factors. This optimism bias often stems from overlooking potential market challenges, competitive pressures, and operational hurdles. Your chosen method should effectively account for any capital constraints your organization faces.

What Is the Difference Between Capital Budgeting and Working Capital Management?

Many projects face cost overruns due to inadequate consideration of all implementation expenses. Many organizations fail to consider what they’re giving up by choosing one investment over another. A comprehensive risk assessment should consider market risks, operational challenges, regulatory changes, and technological obsolescence.

Overlooking opportunity cost implications

Add discounted cash flows cumulatively until they equal initial investment. The techniques of capital budgeting in financial management are essential tools in the modern business toolkit, serving as the foundation for strategic financial planning and growth. These techniques not only help organizations make better investment decisions but also provide a structured framework for evaluating opportunities, managing risks, and optimizing resource allocation. For example, Rudolph Incorporated is considering the X-ray machine that had present value cash flows of $268,400 (not considering salvage value) and an initial investment cost of $200,000. Another X-ray equipment option, option B, produces present value cash flows of $290,000 and an initial investment cost of $240,000.

Accurate forecasting requires detailed market research, historical data analysis, and consideration of various economic factors that might impact future cash flows over the project’s lifetime. First, calculate future value of positive cash flows using cost of capital. Finally, find the nth root of their ratio, subtract 1, and multiply by 100. Through detailed financial analysis and forecasting, techniques of capital budgeting help businesses identify investments that offer the highest potential returns.

Related AccountingTools Courses

This heightened scrutiny leads to a more detailed analysis of potential returns, strategic importance, and long-term benefits. Capital rationing compels organizations to develop more rigorous project ranking systems to identify investments that deliver maximum value within resource constraints. Management preferences regarding project size, duration, risk level, and strategic alignment can impact project selection and evaluation criteria. The pace of technological advancement significantly influences capital budgeting decisions, particularly in technology-intensive industries.

Discounted cash flow (DCF) is a valuation method used to estimate the value of an investment based on its future cash flows. DCF analysis discounts future free cash flows to the present using a discount rate to account for the time value of money. Using DCF analysis brings future cash flows back to today’s dollars or euros using a discount rate, which captures both the time value of money and investment risk. The time value of money means that money available immediately is worth more than the same amount in the future due to its potential earning capacity. Discounted cash flow (DCF) is an analysis method used to value investment by discounting the estimated future cash flows. DCF analysis can be applied to value a stock, company, project, and many other assets or activities, and thus is widely used in both the investment industry and corporate finance management.

This article breaks down the discounted cash flow DCF formula into simple terms. We will take you through the calculation step by step so you can easily calculate it on your own. The DCF formula is required in financial modeling to determine the value of a business when building a DCF model in Excel. The company would need to estimate the future cash flows that the factory is expected to generate. One of the major advantages of DCF is that it can be applied to a wide variety of companies, projects, and many other investments, as long as their future cash flows can be estimated. Without considering the time value of money, this project will create a total cash return of $180,000 after five years, higher than the initial investment, which seems to be profitable.